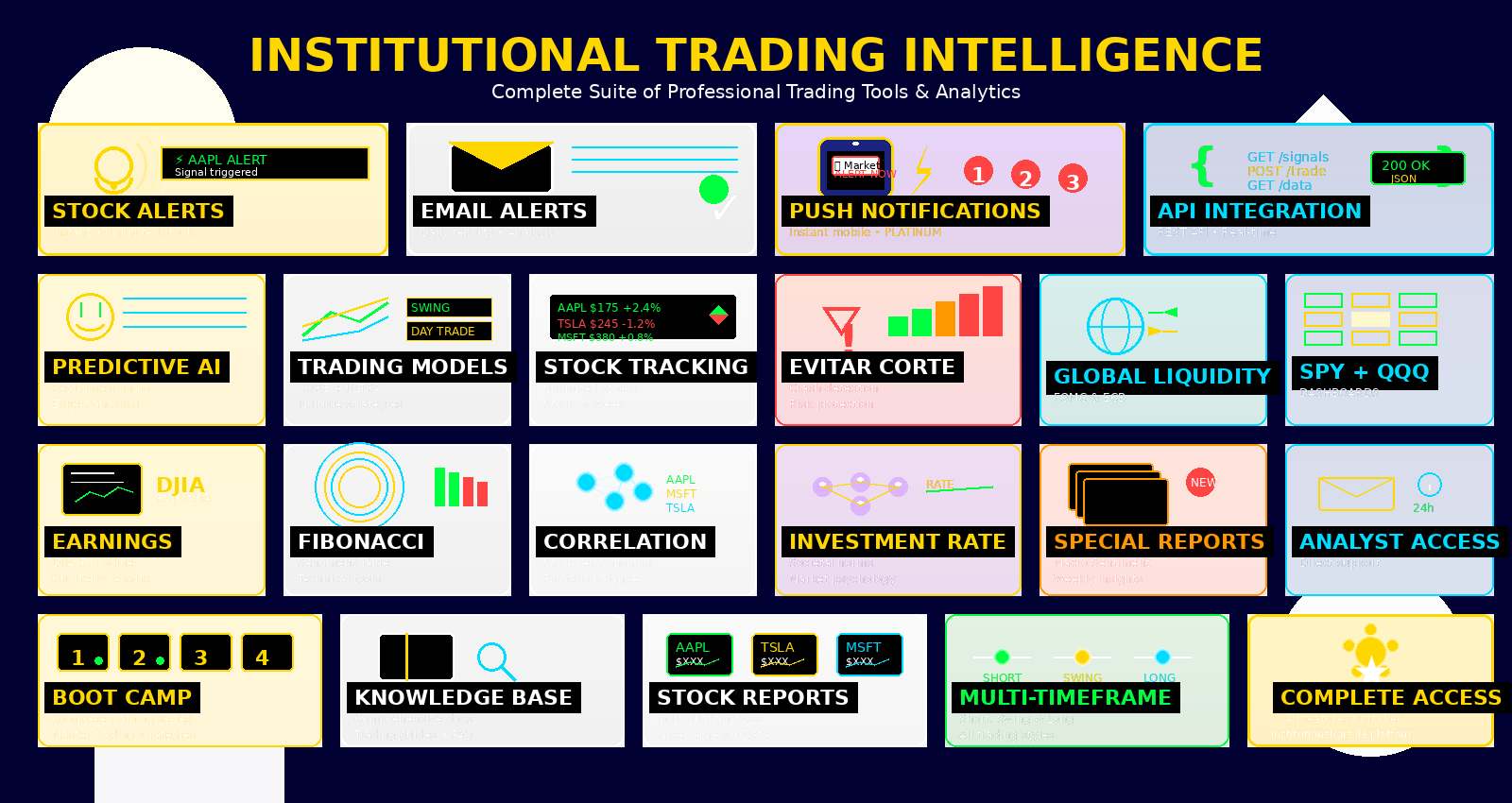

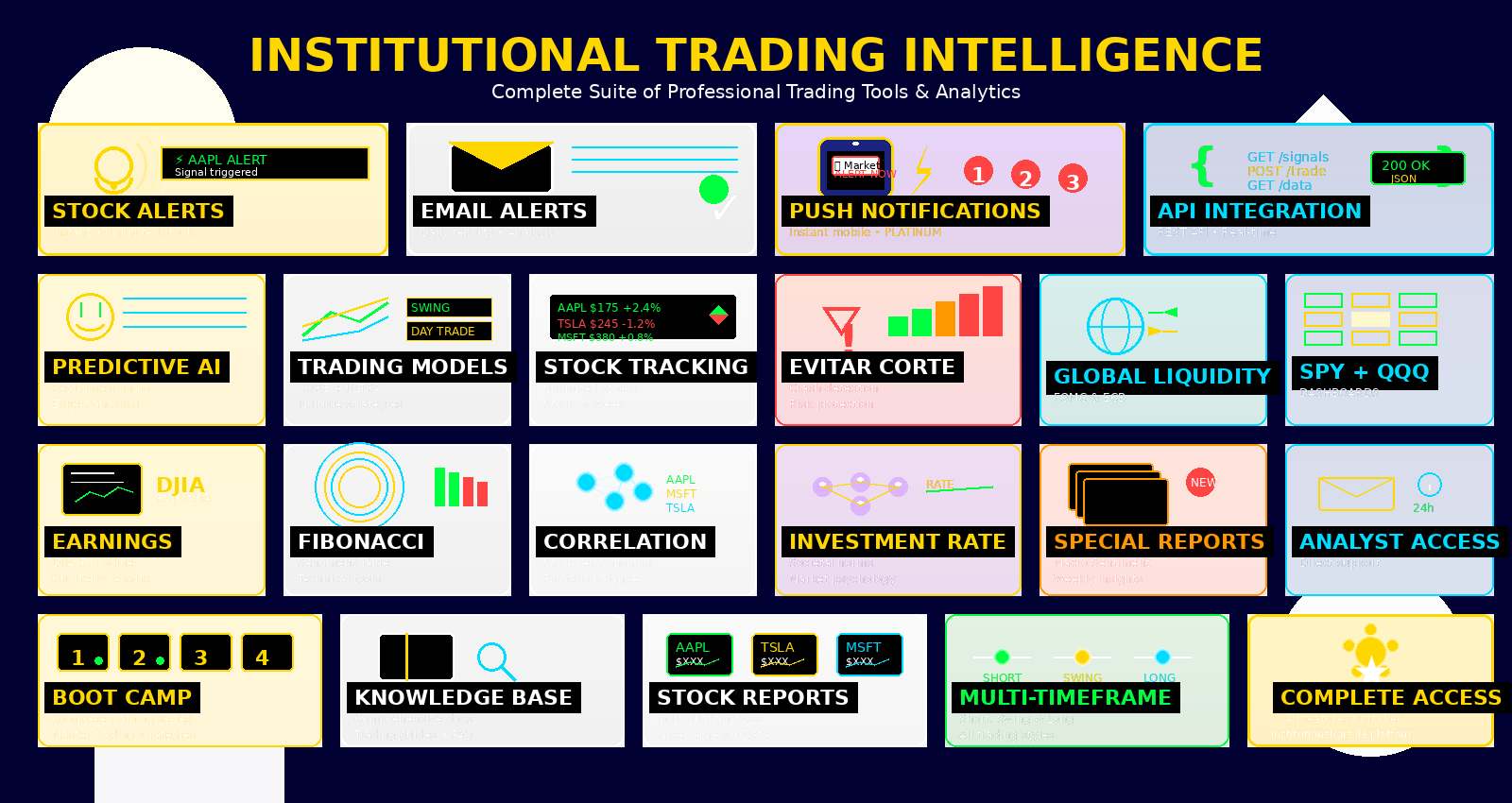

Industry leading accuracy with proven predictive AI delivering institutional-grade insights. 25 years of performance serving over 100,000 professional investors. Access the same intelligence used by leading hedge funds and asset managers.

Access your professional dashboard

From billion-dollar funds to successful individual traders

"When I first joined in 2014, I agreed with your proactive strategy but struggled to break old habits. Eventually, I embraced your methodology and the results have been dramatic. I now sleep better knowing I've removed emotion from my investment decisions."

"I don't know what your other subs do, but over the last 250+ trading days I've only had 3 losing days—and each of those losses didn't exceed 0.10%! Just keep doing what you do. Appreciate it!"

"Stock Traders Daily is imperative to have as a guide for your portfolio. It helped my family and me stay calm during a crisis and avoid major losses. Sound judgment and daily analytics make it the best money spent for real-time support."